Allowance Allocation to Industrial Facilities

Contact

Overview

CARB annually allocates allowances to industrial facilities covered by the Cap-and-Trade Program to minimize emissions leakage while preserving incentives to maintain efficient production within California. Emissions leakage can occur when production moves out-of-state, so there appears to be a reduction in California’s greenhouse gas (GHG) emissions, but the production and emissions have been simply relocated.

Sections 95870(e), 95871(d), 95890(a), and 95891(a)-(c) of the Cap-and-Trade Regulation (Regulation) describe allowance allocation for industrial assistance. In October each year, CARB allocates allowances from the upcoming budget year to eligible industrial facilities. For example, in October 2019, CARB allocated vintage 2020 allowances. To be eligible for allowance allocation, an industrial facility must conduct an activity listed in Table 8-1 of the Regulation and must have complied with all Mandatory Reporting Regulation (MRR) requirements.

The annual allowance allocation to an industrial facility is calculated by either a product-based or energy-based method. The product-based allocation method is updating, meaning that the final allocation amount for a given year is ultimately based on the amount of actual production at the facility in the relevant year. The energy-based allocation method is not updating; it is based on the amount of energy used during a historic period, and it does not change based on the amount of actual production at the facility in the relevant year. Summaries of industrial allowance allocation for each vintage year are available at the Cap-and-Trade Program Data webpage.

Product-Based Allocation Method

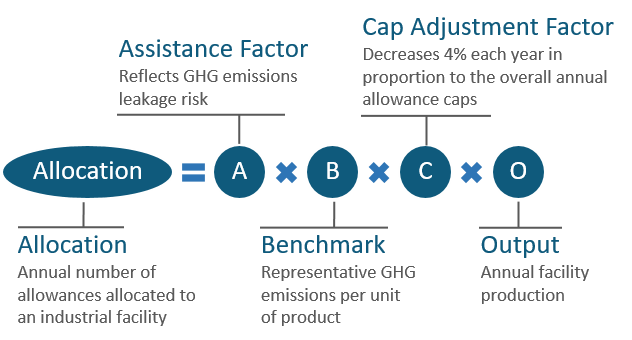

Product-based allocation is CARB’s preferred industrial allocation method because it preserves incentives for efficient in-State production. Over 98 percent of industrial allocation is calculated by the product-based method. The product-based method is applied to eligible facilities that produce a product with a benchmark listed in Table 9-1 of the Regulation. Product-based allocation is calculated using equations in section 95891(b) of the Regulation, which are described in a simplified form here:

For each product, annual facility allowance allocation is dependent on the facility output scaled by the assistance factor, benchmark, and cap adjustment factor. Assistance factors reflect leakage risk for industrial sectors and are listed in Table 8-1 of the Regulation. Assistance factors were originally conceived to be in the range 0-100 percent depending on the level of leakage risk and were set at 100 percent for all sectors by AB 398. Benchmarks are representative greenhouse gas emissions per unit of specific product and are listed in Table 9-1 of the Regulation. The cap adjustment factor declines each year in proportion to the overall annual allowance caps and decreases 4 percent per year during the period 2020-2030 as established in Table 9-2 of the Regulation. Facility output is the annual facility production of a specific product as reported and verified pursuant to the MRR. See the Background section below for details on the development of assistance factors and benchmarks.

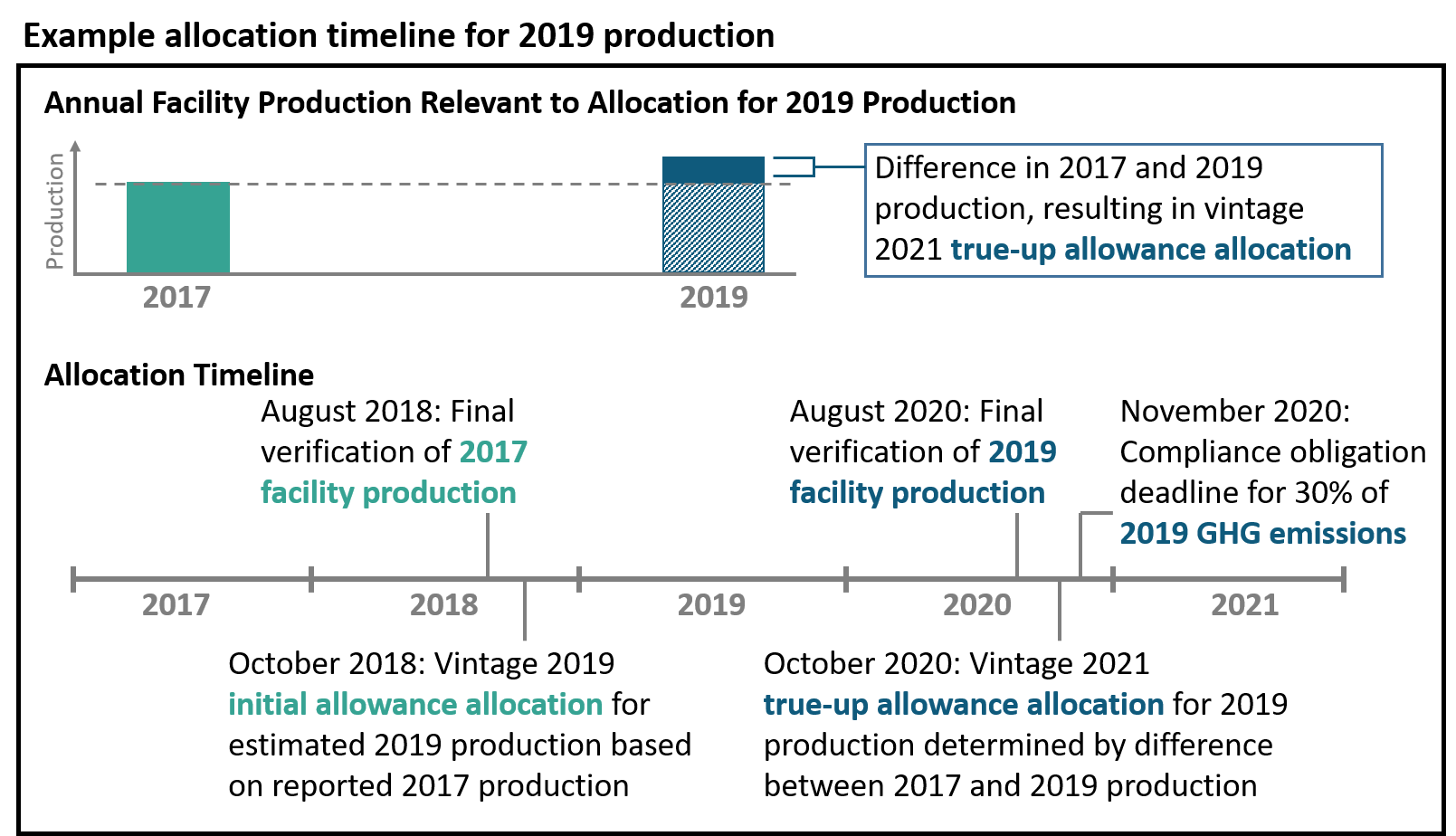

In the product-based method, CARB provides the final allocation for production in a given year in two parts: (1) an initial allocation provided in the October prior to the year, and (2) a true-up allocation provided in the October after the year. Initial allocation is provided in advance of the year to give entities additional flexibility when planning for compliance. Initial allocation is an approximate amount based on the most recently verified production data, and initial allocation is later adjusted to the appropriate final allocation by true-up allocation. True-up allocation is determined after product data for the given year are verified and may be a positive or negative value.

This example timeline shows the timing of initial allocation and true-up allocation to arrive at the final allocation for facility production in 2019.

For example, in October 2018 CARB provides vintage 2019 initial allocation based on 2017 production data (the most recent production data available) to approximate the final allocation for 2019 production. Then in October 2020, after actual 2019 production data are verified, CARB provides vintage 2021 true-up allocation. True-up allocation adjusts the vintage 2019 initial allocation to the appropriate final allocation for actual 2019 production.

When true-up value is assigned to an amount of allowance allocation of a certain vintage, it allows an entity to surrender that amount of allowances of that vintage to meet a current compliance obligation. For example, if an entity receives vintage 2022 true-up allocation, the entity could surrender a number of vintage 2022 allowances, up to the true-up quantity, to meet the 2018-2020 full compliance period compliance obligation at the November 1, 2021 deadline. True-up allowance value is specific to the entity receiving the true-up allocation, and true-up value cannot be transferred to any other entity.

Energy-Based Allocation Method

Energy-based allocation is CARB’s fallback industrial allocation method that may be applied for certain sectors where the product-based method is not plausible. For vintage 2020 allowance allocation, less than two percent of industrial allocation was calculated by the energy-based method. The energy-based method is applied to eligible facilities that do not produce a product with a benchmark listed in Table 9-1 of the Regulation.

Energy-based allocation is based on the amount of energy used at the facility during a historic period as described in section 95891(c) of the Regulation. CARB provides allocation for production in a given year only as an initial allocation provided in the October prior to the year. Unlike the product-based method, the energy-based method does not depend on annual production, so facilities with energy-based allocations generally do not receive true-up allocations. Consistent with the product-based method, the allocation is provided in advance of the year to give entities additional flexibility when planning for compliance.

Industrial facilities that are new entrants to the Cap-and-Trade Program and are eligible for energy-based allocation may need to submit additional steam and fuel consumption data to CARB. Please contact the industrial team lead provided in the Contact Us section below for more information.

Background

For background information on CARB's rationale for industrial assistance at the inception of the Cap-and-Trade Program see:

For details on the assessment of the level of leakage risk for each sector see:

- Leakage Analysis (2010 Regulation, Appendix K to the Initial Statement of Reasons)

- Leakage Risk Analysis for New and Modified Sectors (2013 Regulation, Appendix B to the First 15-Day Notice)

For details on the development of a variety of GHG efficiency benchmarks see:

- Development of Product Benchmarks for Allowance Allocation (2010 Regulation, Appendix B to the First 15-Day Notice)

- New and Modified Product-Based Benchmarks (2013 Regulation, Appendix C to the 45-Day Notice)

- Additions and Amendments to Product-Based Benchmarks in the Cap-and-Trade Regulation (2013 Regulation, Appendix A to the First 15-Day Notice)