ZEV Exemptions Require Cleanest Engines

Categories

Contact

Background

The proposed Advanced Clean Fleets (ACF) regulation requires regulated fleets to transition to zero-emission vehicles (ZEV) over the course of the next two decades and sets an end-date for internal combustion engine vehicle sales in 2036.

As currently drafted, in the proposed ACF regulation, fleet owners that receive ZEV purchase exemptions would be required to purchase new engines meeting California standards. Details are available on the ACF Regulation Summary Fact Sheet (https://ww2.arb.ca.gov/resources/fact-sheets/advanced-clean-fleets-regu…). These internal combustion engines must meet the nation’s most stringent emissions requirements; the requirements of California’s Heavy-Duty Omnibus (HD Omnibus) regulation.

Stakeholder Request

Some stakeholders have been requesting amendments to the proposed ACF regulation to require fleet owners to preferentially purchase natural gas (methane) engines often referring to them as “cleanest combustion”, in the situation where a zero-emission truck is not available for purchase. Although the stakeholder proposal to provide the "cleanest combustion" sounds as if it would provide an environmental benefit, it does not. More specifically, issues with the proposal include:

- No additional criteria emissions/health benefits

- No additional greenhouse gas benefits

- Potential for stranded assets

Background on Heavy-Duty Omnibus Regulation

The HD Omnibus regulation sets the most stringent criteria emission standards feasible for medium- and heavy-duty engines (including diesel and natural gas/methane) sold in California. The standards begin at 0.05 g/bhp-hr NOx with the 2024 model year and ratchets down to 0.02 g/bhp-hr NOx beginning with the 2027 model year. The HD Omnibus regulation includes a number of emissions control requirements to improve real-world emissions performance including significant improvements to older test methods and emissions control requirements.

The HD Omnibus regulation uses an averaging, banking, and trading system that allows manufacturers to sell a mix of engines above and below the standards as long as their total sales meet the overall standard. The Board deemed this flexibility was a necessary part of the regulation to provide engine manufacturers flexibility to phase-in increasing sales of lower emitting engines through 2027, while phasing out sales of legacy engines. The HD Omnibus regulation also includes a credit mechanism to encourage engine manufacturers to certify to the lower standards early. As of April 20, 2023, manufacturers are in the process of certifying their engines to the 2024 standard and no engines have been certified the 2027 standard, regardless of fuel type.

Issues

No Additional Criteria Emissions/Health Benefits

New sales

Because the HD Omnibus regulation uses an average, banking, and trading system, the sale of an engine certified below the standard means another higher emitting engine can be sold. For this reason, the stakeholder proposal would not achieve any additional emissions benefits.

In addition, the proposal would effectively mean that affected fleet owners would not be able to purchase any other HD Omnibus engines after the first one was certified below the required compliance average.

In-use emissions

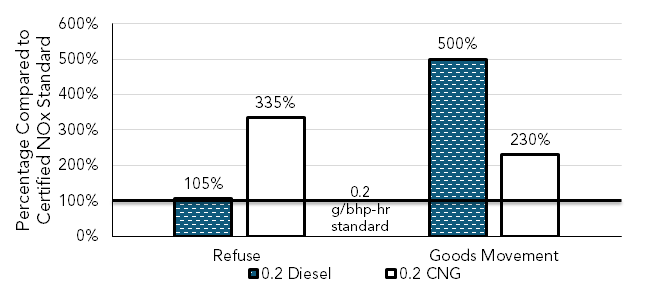

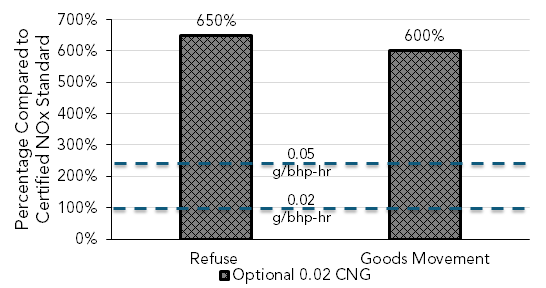

The 200 Truck Study is a comprehensive study of the in-use emissions from 200 diesel and natural gas (methane) trucks and was funded by the South Coast Air Quality Management District, the California Energy Commission, California Air Resources Board (CARB), and Southern California Gas Company. A summary of the results from the 200 Truck Study (https://ww2.arb.ca.gov/sites/default/files/2021-04/Natural_Gas_HD_Engin…) are shown in the graphs below for trucks that are certified to pre-HD Omnibus standards.

- The data shows that in-use emissions for these relatively new diesel and natural gas (methane) engines are significantly above the certified emissions level for NOx.

- As shown in Figure 1 natural gas (methane) trucks in this study on average operate higher than their certified emission level and have higher NOx emissions than existing diesel trucks in some applications.

- In the same study, as shown in Figure 2, natural gas (methane) vehicles that were certified to the older pre-HD Omnibus optional 0.02 g/bhp-hr standard for NOx emitted at over six times the 0.02 g/bhp-hr emission level in real world operation.

The HD Omnibus regulation assures all truck engines are designed to be cleaner and remain that way in real world operation through improved testing procedures and longer warranties than older pre-HD Omnibus standards.

Figure 1: Real-World Emissions of Pre-HD Omnibus 0.2 NOx Engines Higher than Standard

Figure 2: Real-World NOx Emissions of 0.02 CNG Engines Higher than pre-HD Omnibus Optional Standard

No Additional Greenhouse Gas Emissions Benefits

Stakeholder suggestions to require the use of biomethane (or renewable natural gas) in California would not generate new emission benefits beyond what is already expected.

- Emission benefits and cost associated with biomethane production are a result of the California’s Low Carbon Fuel Standard (LCFS) program and the federal Renewable Fuel Standard.

- No additional benefits can be claimed in the ACF regulation as CARB cannot

“double-count” the fuel switching that is occurring due to the LCFS regulation. - Consistent with the 2022 State Scoping Plan (https://ww2.arb.ca.gov/sites/default/files/2022-12/2022-sp.pdf), the draft CARB Board ACF Resolution contains a commitment to continued coordination with relevant State agencies regarding transitioning biomethane into hard to decarbonize sectors.

Potential for Stranded Assets

Engine manufacturers are making significant investments to bring HD Omnibus-compliant diesel, gasoline, and alternative fueled engines to the California market.

- Setting a requirement that would effectively ban the sale of many of these engines from large portions of the California market would invalidate these investments and create an unequal playing field for industry.

- The stakeholder proposal would potentially require new natural gas (methane) infrastructure to be installed and a time when natural gas infrastructure is declining. These new investments in combustion infrastructure would quickly become a stranded asset as the fleet transitions to ZEVs.