FAQ: The Standardized Regulatory Impact Assessment for the Low Carbon Fuel Standard

Categorías

What is the Low Carbon Fuel Standard?

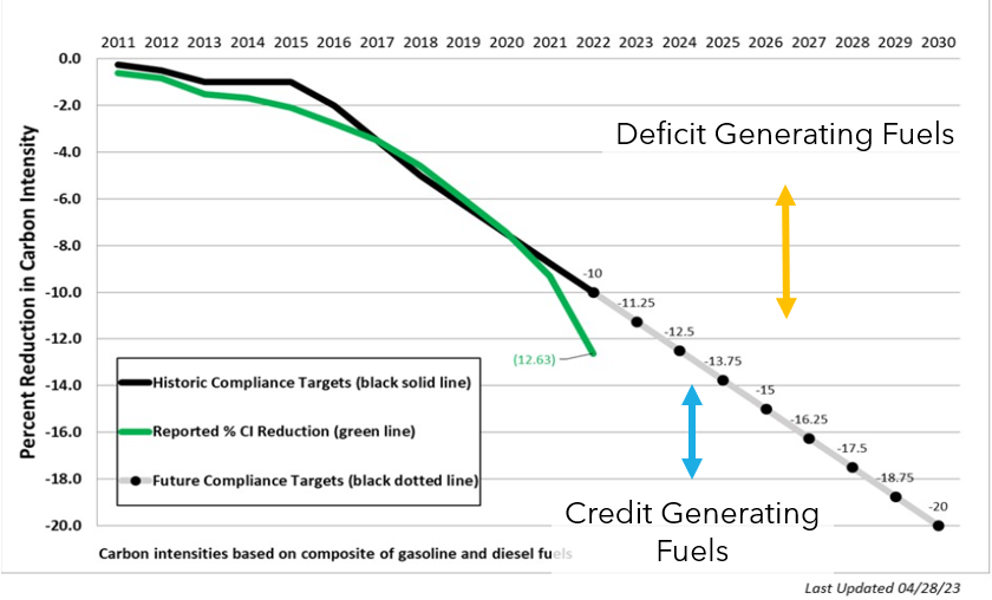

The Low Carbon Fuel Standard requires fuel producers to reduce the carbon intensity (CI) of fuels sold in California and encourages the production of renewable alternatives by requiring higher carbon fuel producers to buy credits from companies that sell cleaner fuels if they miss the mandated targets. The program has reduced the state’s dependency on petroleum fuels, created the renewable fuel sources that are powering cleaner transportation options as the sector moves toward zero emissions, and have contributed to clean air improvements that bring public health and climate benefits to California’s communities. The program works by establishing an annual, declining carbon intensity (CI) target for transportation fuels used in California. The less carbon in a fuel, the more credits can be generated in the program. Entities with high carbon fuels such as gasoline and diesel generate deficits, and they need to purchase credits to comply with the annual target. All liquid transportation fuels are regulated by the regulation and voluntary clean fuel producers can opt-in to the program.

Clean fuels include electricity, hydrogen, renewable diesel, and biofuels. Each fuel that generates credits in the program has to go through an evaluation by CARB staff and a third party to validate that the fuel is in fact low-carbon.

As the CI targets get lower each year, some fuel types may start to generate fewer credits. Some fuels, depending on their CI score, may eventually flip from being a credit generator to a deficit generator. In this way, the LCFS structure creates a strong incentive to deploy only the lowest carbon fuels to California and to continually innovate to reduce the carbon intensity of existing fuels. In the first quarter of 2023, LFCS was responsible for displacing more than 50% of the diesel used in California, as users switched to cleaner alternatives.

As the green line indicates, the program has outperformed its benchmarks, meaning even more reductions are happening than anticipated. This is a great outcome for Californians and given the state’s long-term climate and air quality goals, the aim is to continue accelerating reductions.

What is a Standardized Regulatory Impact Assessment (SRIA)?

Senate Bill 617 (Chapter 496, Statutes of 2011) established additional regulatory impact assessment standards for major regulations. A state agency must conduct a Standardized Regulatory Impact Assessment (SRIA) when it estimates that a proposed regulation has an economic impact exceeding $50 million. The Department of Finance has adopted regulations for all state agencies to follow when conducting a SRIA for major regulations. The Department of Finance (DOF) is required to review the completed SRIA and provide comment(s) to the agency on whether the assessment adheres to the regulations adopted by the Department of Finance (DOF).

The LCFS SRIA was submitted to the Department of Finance on September 8, 2023, to meet these requirements ahead of the release of a draft regulatory proposal and, review and eventual vote by the California Air Resources Board. Agencies cannot release draft regulatory language for a formal 45-day comment period for at least 60 days once a SRIA is submitted to DOF. The SRIA is an initial economic evaluation of potential changes to the LCFS and the submittal of the SRIA is one of many steps CARB must take prior to updating the LCFS Regulation.

The SRIA must include a “proposed scenario” and two alternatives that provide a range of options for amendments. These early staff proposals allow for a “snap-shot” evaluation of economic impacts and benefits of choices that could inform a subsequent formal regulatory proposal, but do not necessarily offer a prediction on economic impacts. Rather, it is a way of assessing what the impacts could be, often using conservative scenarios to help illustrate the possibilities and help guide informed decisions, including about what changes need to be made as proposals make their way through the public process and ultimate vote by the Board. As such, the SRIA helps inform formal amendments to the LCFS regulation and is not itself a staff proposal that would be considered by the CARB Board.

After a SRIA is released, CARB staff continues to engage with stakeholders and evaluate data to help inform a formal 45-day regulatory proposal. As part of that 45-day formal regulatory proposal, staff updates the analyses for the economic impacts and benefits to reflect any changes since the release of the SRIA.

Why is CARB proposing to increase the stringency of the LCFS?

Last year, the CARB Board approved the 2022 Scoping Plan Update, which assessed progress to the 2030 greenhouse gas target in SB 32 and achieving the targets in Assembly Bill 1279. AB 1279 calls for both reducing anthropogenic emissions 85% below 1990 levels and reaching carbon neutrality no later than 2045.

Many of the strategies that the state is using to address climate change and achieve carbon neutrality are the same strategies that will also drastically improve air quality. Transportation emissions, primarily from the use of fossil fuels, are the single biggest source of greenhouse gas emissions and poor air quality. The state is working hard to increase the numbers of zero-emission vehicles on the road and deploy cleaner fuels. Successful implementation of the 2022 Scoping Plan would reduce fossil fuel use by 94% by 2045.

Even with an unprecedented and rapid transition to ZEVs, California will still have some remaining demand for liquid fuels in the transportation system given the remaining combustion vehicles on the road, aviation, and potentially some offroad applications that will continue operating in the state.

The Board has already taken steps towards the goals identified in the Scoping Plan, by adopting regulations such as Advanced Clean Cars 2, Advanced Clean Fleets, Advanced Clean Trucks, Innovative Clean Transit, and other rules that promote and hasten the deployment of low and zero-emission technologies.

The LCFS is part of that transportation decarbonization story. The LCFS provides the economic incentives to produce cleaner fuels like electricity, hydrogen, and the biofuels needed to displace fossil fuels and reduce transportation sector emissions.

What is the impact of LCFS on fuel costs?

Retail fuel prices are strongly influenced by many factors beyond LCFS credit prices (e.g., global events, holiday weekends, seasonal fluctuations, refinery disruptions, seasonal fuel blends, taxes) and fuel producer pricing strategies are complex and reflect local and regional market conditions. Few of these factors are determined by government entities, including the state of California. Between 2017 and 2022, the retail price of gasoline fell as low as $3.08 and rose as high as $5.41, and similarly for diesel, the retail price ranged between $3.07 and $6.02.[1] Predicting how LCFS credit price changes impact these complex pricing strategies is beyond the scope of this work.

The SRIA includes an analysis on retail fossil fuels as an estimate of the upper bound of possible consumer price impacts based on the carbon content of fuel. As such it is an upper bound taking a very conservative approach. Importantly, it does not represent the actual cost pass-through that will happen in the real world. Actual costs of pass-through depend on how much fossil fuel is still in use, the supply of clean fuel, and credits in the market. Fossil fuel in use and deficits under the Program will go down over time as the zero-emissions vehicle (ZEV) population increases. Clean fuels will increase as the program becomes more stringent and a stronger market signal is supported. It’s also important to recognize that the costs of some of the lowest carbon fuels is expected to fall over time if the technology to produce and use these fuels can be adequately deployed. Federal incentives and funding can also help support clean fuel production and deployment at lower costs. Finally, the program has a price ceiling to ensure credit prices do not go unchecked. This further ensures that the cost pass-through is managed and unnecessary costs of the program are not passed on to consumers.

[1] Source: United States Energy Information Administration. Annual Retail Gasoline and Diesel Prices (updated July 31, 2023). https://www.eia.gov/dnav/pet/pet_pri_gnd_dcus_sca_a.htm. Accessed August 7, 2023.